do you have to pay taxes on inheritance in tennessee

Be aware of that your assets located in other states may be subject to that localitys inheritance or estate tax. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1.

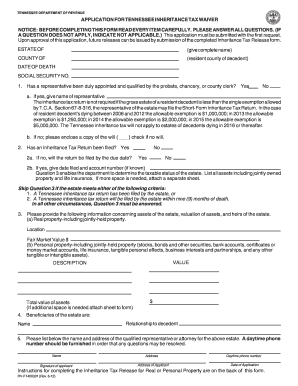

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

He said given that your cousin lived in New Jersey at the time of death your proportionate.

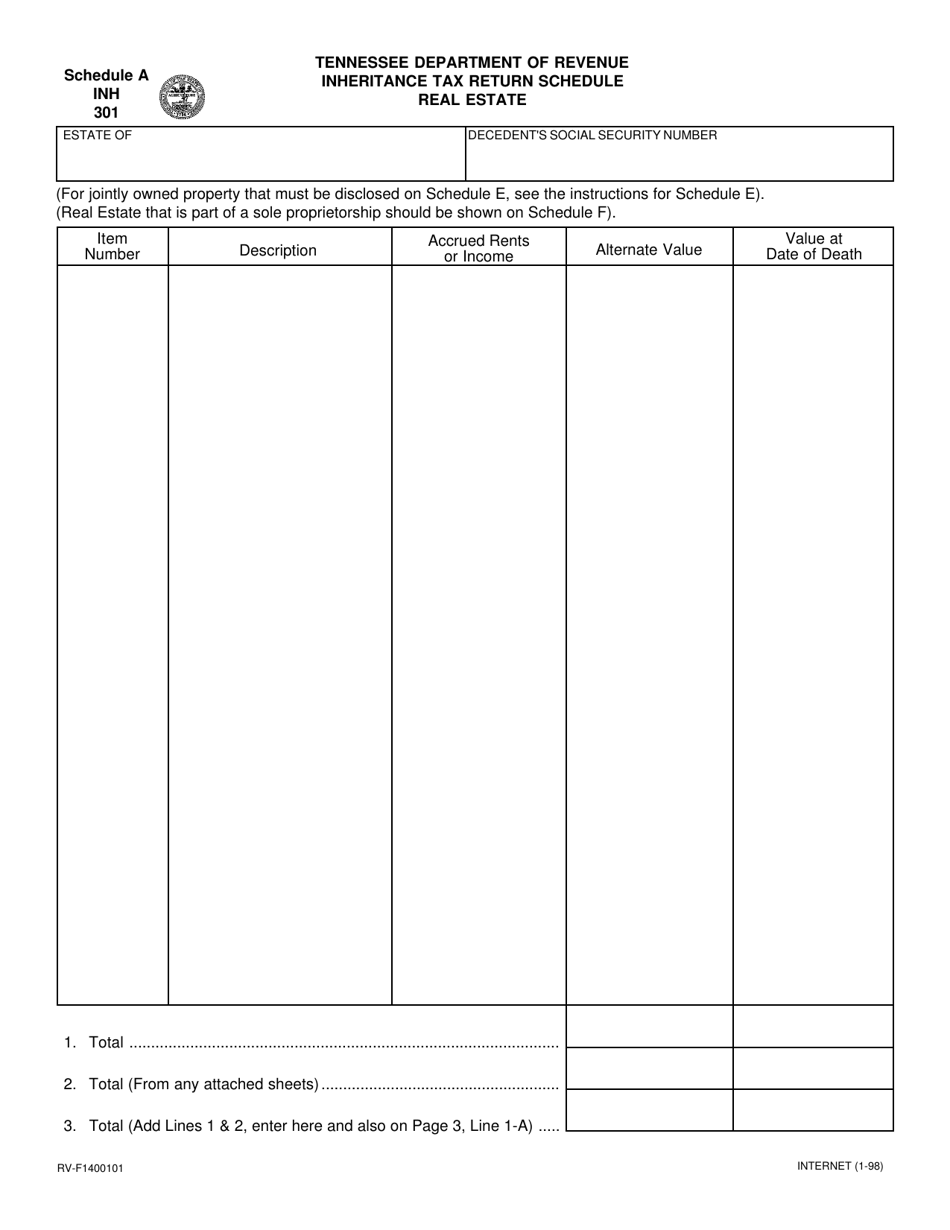

. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. State tax ranges from business and sales tax to inheritance and gift tax. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. The possibility of the government taxing your hard-earned money after your death is a valid concern. For example the neighboring state of Kentucky does have an inheritance tax.

The capital gains tax is the tax you pay for acquiring an asset. Each state is different and taxes can change at the drop of a hat so its a good idea to check tax laws in your state or better yet talk to a tax pro. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

This is a term that describes any tax one may encounter when receiving an inheritance. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. Its up to 1206 million for people who die in 2022 2412 million for a married couple.

If you do owe Tennessee state taxes other than income tax you can learn more about what is taxed at the TN Department of Revenue website. Generally states that tax inheritances exempt a certain amount per. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. State rules usually include thresholds of value. To pay taxes you may do so online at httpstntaptngoveservices_.

Each has its own exemption amount and tax rate ranging from the most taxed NJ with an exemption of only 675000 to the 5430000 HI. Uncle Sam doesnt have an inheritance tax and inheritances are not considered taxable income in most casesso you wont have to report your inheritance on your state or federal income tax return. All inheritance are exempt in the State of Tennessee.

The first rule is simple. Thats because federal law doesnt charge any inheritance taxes on the heir directly. However some states have uncoupled estate tax exemptions.

There are NO Tennessee Inheritance Tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. How Do Inheritance Taxes Work.

The inheritance tax is a tax charged to the recipient of the estate. Now for some good news. As you plan for your financial future and its a good.

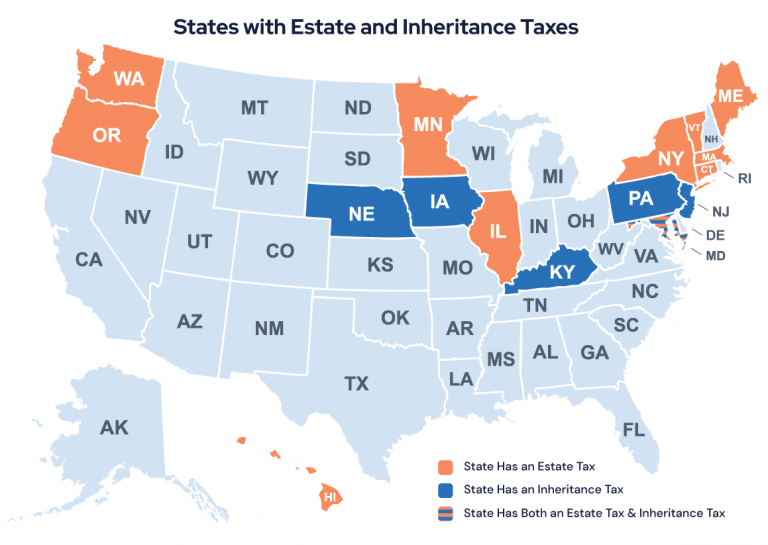

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. All inheritance are exempt in the State of Tennessee.

It means that even if you are a Tennessee resident but have an estate in Kentucky your. ME VT CT MA RI NY NJ MD TN IL MN OR WA and HI. You will get a boost in basis for all assets up to the date you die.

The 2017 tax reform law raised the federal estate tax exemption considerably. Even though Tennessee does not have an inheritance tax other states do. Tax rates and laws vary depending on the state and rates are.

Before that law was enacted the exemption was 549 million per person for decedents who died in 2017. The Federal estate tax only affects02 of Estates. There are NO Tennessee Inheritance Tax.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. Technically Tennessee residents dont have to pay the inheritance tax. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value.

Inheritance Tax by State. Inheritance Tax in Tennessee. Inheritances that fall below these exemption amounts arent subject to the tax.

However it applies only to the estate physically located and transferred within the state between Tennessee residents. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. As you noted cousins are known as Class D beneficiaries.

No Longer a Gift Tax in Tennessee. Other than the Inheritance and Estate taxes there are other taxes that you might have to pay. The inheritance tax is levied on an estate when a person passes away.

The inheritance tax is paid out of the estate by the executor. Any bequest of 700000 or less to a Class D beneficiary is subject to a 15 inheritance tax while any amount in excess of 700000 is subject to a 16 inheritance tax Rheingold said. You would pay an inheritance tax of 11 on 25000 50000 - 25000 when it passes to you.

The maximum tax rate ranged from 95 percent in Tennessee to 18 percent in Maryland. For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in. The taxes that other states call inheritance.

If you receive property in an inheritance you wont owe any federal tax. All inheritance are exempt in the State of Tennessee. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live.

So do you pay taxes on.

How To Settle An Estate Pay Final Bills Dues Taxes And Expenses Everplans

Gift And Estate Tax Exclusions 2022 Cool Springs Law Firm Brentwood Tn

How To Avoid Paying Taxes On Inherited Property Kake

Inheritance Tax Checklist Know Before You Sell Sensible Money

Form Rv F1400101 Inh301 Schedule A Download Printable Pdf Or Fill Online Inheritance Tax Return Schedule Real Estate Tennessee Templateroller

![]()

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Gift And Estate Tax Exclusions 2022 Cool Springs Law Firm Brentwood Tn

Inheritance Tax Checklist Know Before You Sell Sensible Money

Receiving An Inheritance While On Medicaid

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Do I Owe Taxes If I Got Money From My Mother When She Died

A Guide To The Best And Worst States To Retire In

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

A Guide To The Best And Worst States To Retire In

Annuity Taxation How Various Annuities Are Taxed

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Inheritance Tax Checklist Know Before You Sell Sensible Money